Overview:

Within an organization, it is very common to have a scenario where an employee has been assigned to multiple assignments and working in two different state and wants to split the taxes for the earnings between the two states. This article will explain the importance of “Employee Earnings Distribution Overrides” calculation card within Oracle HCM Cloud and functionality to accomplish this requirement with the configuration at assignment level.

We will see the payroll run for tax deduction, within Oracle HCM Cloud, with and without the additional configuration and the difference in payroll result of the tax deduction details.

The payroll runs without any additional configuration.

The total earnings are 3918.05

- Salary Earning Results: 3913.65

- Earnings Result: 4.40

The payroll runs with additional configuration.

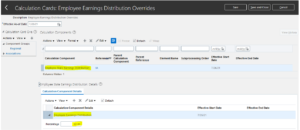

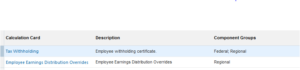

Add the calculation card “Employee Earnings Distribution Overrides”

Select the “Employee State Earnings Distribution” as IA (as an additional state tax calculation for earnings”)

Update the Percentage of earning for state tax calculation.

Click “Save and Close” button

Additional calculation card will be added.

Run the quick pay for this employee.

Observation on earnings calculation after the “Employee Earnings Distribution Overrides”

- Salary Earning Results 2348.19 + 1565.46 == 3913.65

- Earning Results 2.64 + 1.76 == 4.40

This earning’s sum is same first payroll run.

We noticed that the earnings are split into the percentage defined in “Employee Earnings Distribution Overrides” card creation. i.e.

3913.65 * 60% == 2348.19

4.40 * 60% == 2.64

Similarly, the remaining earnings are 40% calculations

3913.65 * 40% == 1565.16

4.40 * 40% == 1.76

The state tax is also split into two different tax states

This way the earning is split into two different states and taxes are calculating based on the earnings of the state.

If you need any help with your Oracle HCM Cloud Implementations, Please drop a line here. Our Oracle HCM Cloud experts will contact you promptly.