In today’s global workforce environment, many organizations have employees that work and live in different locations. These employees are required to pay the state and other taxes based on the regulatory rule on the earned wages. Sometimes an adjustment of amount needs to be done based on the employee’s request for W2 file generation. Moreover during the current pandemic environment, most of the employees are working from home and so they would request to generate the W2 file for the state they live in to avoid any confusion.

This article will describe how to handle this scenario in Oracle HCM cloud by using the “Part Year Resident” flag concept and how this is useful in clearing the city tax balance accumulated.

Take the case of an employee whose work location is NY and living location is NJ. The NY city tax needs to be adjusted with the NJ taxes. “Part Year Resident” flag, within Oracle Fusion HCM, is used to clear the city tax.

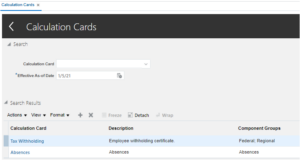

Quarterly Tax file for City Balance Details

![]()

Balance adjustment of NY City Tax i.e., zero out the amount of city tax.

Result is NOT adjusted to zero with default process of balance adjustment.

Adjust the balance so that negative value does not populate

i.e., 611828.38 – 323560.44 == 288,267.94

Similarly, the subject wages are calculated as 589794.88 – 321944.7 == 267,850.18

Run the Quarterly tax file to validate the balance amount

![]()

Gross and Subject wages are not zeroed out instead populated with Federal amount

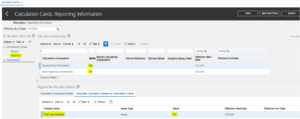

Set the “Part Year Resident” to Yes and generate the quarterly tax file

Add the Calculation Card with “Reporting Information” and set the Region -NY as “Part Year Resident” as Yes

Below is the Quarterly file result

![]()

City tax has been adjusted with the “Part Year Resident” flag to Yes.

I hope this article will help to do balance adjustment in Oracle HCM Cloud for employees that fall within this scenario.