Overview:

In Cloud HCM, a third-party tax file is used to send tax and earning details to ADP for filing taxes for employees. This tax file can be used for generating W2 files for employees by a third party. However, there are scenarios when employee tax is not sent directly to the file like “Oregon Transit Employer Taxes”. These taxes are defined manually by populating the details in the quarterly file. This article will explain the process to create and populate the custom balance with additional configuration in Oracle Cloud HCM which will help to populate the custom balance result in the quarterly tax file.

Below are the steps to accomplish this requirement:

- Discuss with the tax-filing provider if the tax code can be used for the payment process

- Create the deduction element

- Whether this is used for single or multiple jurisdictions

- Configure custom balances

- Prepare for third-party reporting

- Add a deduction element on the element Entry page

- Payroll run for the employee assigned with deduction element

- Run the Quarterly tax file to verify the custom balance feed on file

Let’s learn about them one by one

- Discuss with the tax-filing provider if the tax code can be used for the payment process.

This discussion is needed before making the changes. There is a restriction on tax code value based on tax level. They are:

- Federal: Any alphanumeric value, up to 15 characters.

- State: Any alphanumeric value, up to 13 characters. 2 characters are prefixed automatically with the state postal code.

- County: Any alphanumeric value, up to 10 characters. 2 is state postal code and 3 is county geocode automatically prefixed.

- City: Any alphanumeric value, up to 6 characters. 2 is state postal code, 3 is county geocode and 4 is city geocode automatically prefixed.

- School District: Any alphanumeric value, up to 8 characters. 2 is state postal code and 5 is school geocode automatically prefixed.Create the deduction element

This deduction element is employer tax wages. Suppose there is a need to send the additional tax details to the employer. This element will help to populate the additional amount deduction for the employer component.

3. Whether this is used for single or multiple jurisdictions.

If there is a specific state or city/specific jurisdiction for this deduction then this can be taken care of with modification of the existing fast formula suffix with Tax_CHG_DEDN and CHG_DEDN_CALCULATOR. If there are multiple state or city/multiple jurisdiction deductions then the entry should be at the element entry page. It is recommended to keep the generic one and populate the value at the element entry of the assignment.

4. Configure custom balances

Custom balance is defined with a dimension which stores the value after the payroll run. These balances are column values on the tax file. Hence minimum balances (Such as Gross, “Reduced Subject Wages” and “Taxable Wages”) should be created to populate the expected values on the tax file for a particular tax code.

![]()

Dimension example for Federal. The same list should add to all balances which need to be created.

![]()

5. Prepare for third-party reporting.

Open the HCM Enterprise Information task page and add these custom balances on page. Make sure to assign the same custom tax code name for all balances in the balance assignment section.

![]()

6. Add the deduction element on the element Entry page

7. Payroll run for the employee assigned with deduction element.

8.Run Quarterly tax file to verify the custom balance feed on file.

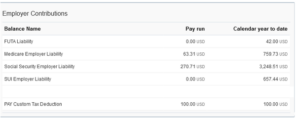

![]()

Custom tax code is available in Quarterly Tax file.

If you need any help with your Oracle HCM Cloud Implementations, Please drop a line here. Our Oracle HCM Cloud experts will contact you promptly.