Overview: In Oracle HCM Cloud, the default balance adjustment process does NOT work for the local wages and taxes amount adjustment for PA state. This article will explain the process for the balance adjustment of local wages and taxes for Pennsylvania state. There could be transaction that, PSD is wrongly entered in TRU associations and payroll has been processed with this wrong PSD code. Correcting the PSD code will solve the issue, which will not populate the local wages and taxes to wrong PSD in next payroll run. But already populated amount values need correction with the balance adjustment. This article describes how to do the balance adjustment in Oracle HCM Cloud

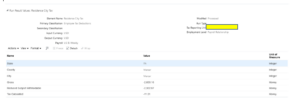

Get the balance amount details to be adjusted. This is the baseline for any balance adjustment activities.

![]()

The above highlighted amount is unexpected population and needs correction.

Normal balance adjustment is to find the city element (Residence or Work) and go with the balance adjustment with input value as state, county, city and respective amount to be adjusted.

Run “Employee Active Payroll Balance Report” to verify the adjustment.

![]()

There is No change in amount adjustment.

Make the balance adjustment with PSD code and “Tax Collection District” Code inputs instead of County and City input.

Run “Employee Active Payroll Balance Report” to verify the adjustment.

![]()

There is No change in amount adjustment.

The trick here is, along with the City balance adjustment with PSD input. The other element “Local Wages and Taxes” needs the balance adjustment.

If the element eligibility is not created for “Local Wages and Taxes” element then create the eligibility of this element. This element will be available in search element parameter.

Run “Employee Active Payroll Balance Report” to verify the adjustment.

![]()

Wrong PSD code has been adjusted successfully.

These processes should help in multiple scenarios like processing the W-2 file or any correction needed after the payroll run process for PA state.