Overview

Oracle HCM Cloud is an industry-leading product that enables organizations to manage all their HR functions. During different HR activities, errors might happen that need to be fixed. We advise and train our customers to deal with several of these scenarios during our Oracle Cloud HCM Implementation. For example, there might be a scenario in which a Payroll run has been processed for the company and payroll for a few employees has been processed with incorrect calculations resulting in incorrect pay stubs. This article explains how to revert the payroll run process for a few employees in the Oracle Fusion HCM application instead of rolling back the whole payroll process. This could be used in any scenario where payroll is not processed correctly for an employee and needs to be rolled back.

Common payroll errors could be:

- Time card flag is not set while hiring an employee and time entries are processed with 3rd Party interface. Payroll run will process the hours with default schedule hours as well as the hours entered through the third-party interface. This will result in overpayment to employees.

- Any scenarios (like tax calculation amount, Standard earnings/Supplemental earnings not processed as expected and costing issues with elements) are NOT processed which is needed to revert the payroll for employees.

There are a couple of processes to generate the pay stubs for employees. Reversing the payroll run for affected employees is like rolling back each process.

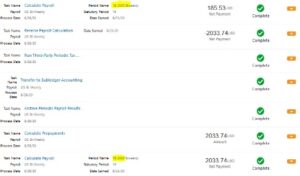

The steps should be:

- GL entries should be corrected for accounting correction.

- Rollback of Processes like (Payslip, EFT and Check)

- Create an object group for the affected employee.

- Run the process “Reverse Payroll Calculation” with the object group.

- Run Calculate Payroll with object group

- Run Prepayment with the same date. (Normally it is the process date)

- Run Archive payroll result with the same date

- Run Check payment process

- Run EFT process

- Run Generate payslip with object group

It is found that the pay stub is NOT correct for this employee, which means it NEEDS CORRECTION.

Reverse Payroll Process

Follow the steps below to accomplish this

- Roll Back Payslip, Check

- Run “Reverse Payroll Calculation”

Run the payroll run for this employee using the object group. Make sure to run the prepayment and Archive Periodic Results with the same date (e.g. Process Date).

In the end, Payroll is corrected for the affected employee. If there is more than one employee then include them in the object group and follow the above steps.

We hope this helps you understand the process to correct the errors in your payroll runs.

Conclusion

Ensuring accurate payroll is essential for the smooth operation of your business. If you’ve encountered errors in your payroll runs, don’t hesitate to take action. Whether it’s correcting payroll for a single employee or multiple individuals, following the outlined steps diligently is crucial. Remember, precision in payroll leads to happier employees and a more efficient workplace.

If you need further assistance or have any questions about the process, feel free to reach out to our dedicated Oracle Cloud HCM team at Tangenz. Let’s work together to streamline your payroll procedures and ensure accuracy every step of the way.